What Is Student Debt

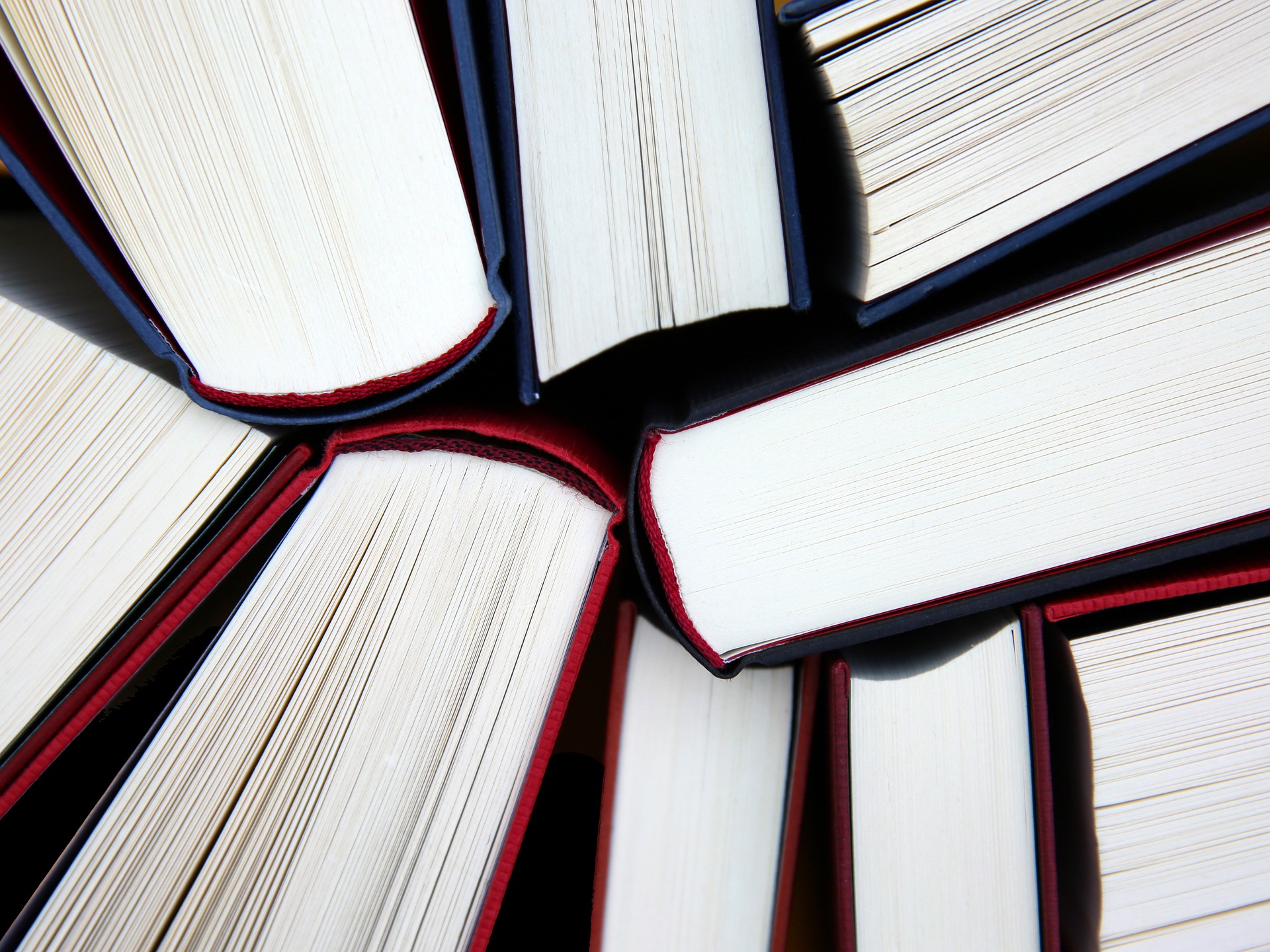

Student debt, often known as student loans. It is the financial commitment that students incur to support their higher education. These loans can be obtained from the government or private lenders. They diffinatly allow numerous people to pursue their ambitions of obtaining a college degree. Nevertheless they also impose a substantial financial burden.

The Rising Cost of Education

For decades, the cost of higher education has steadily climbed, outpacing inflation. As a result, students must incur additional debt in order to afford their education. Tuition, textbooks, housing, and other necessities are all becoming more expensive. When graduates enter the labor market, they face enormous debt.

Types of Student Loans

Student loans are divided into two types depending on who issued them: the government or private lenders.

- Federal Loans: These government-backed loans frequently offer lower interest rates and more favorable repayment terms. They are accessible in several forms: Subsidized loans, Unsubsidized loans, and PLUS loans. Federal loans are the preferred option for the majority of students due to their benefits and flexibility.

- Private Loans: Banks, credit unions, and other private financial entities make private loans. They have higher interest rates and fewer repayment options than government loans. When federal loans do not cover the entire cost of attendance, students may seek private loans.

Federal Loan Programs

Because of their borrower-friendly terms and varied repayment choices, federal student loans are often the first choice for borrowers. Here is an overview of some of the most important government loan programs:

- Direct Subsidized Loans: Undergraduate students who have proved financial need are eligible for these loans. The government pays the interest on these loans while you are in school and during specified deferment periods.

- Direct Unsubsidized Loans: Undergraduate and graduate students, regardless of financial need, are eligible for these loans. Interest begins to accrue the minute you get the loan, though you have the option of deferring interest payments while in school.

- Direct PLUS Loans: Graduate students and parents of dependent undergraduate students are eligible for these loans. These loans, unlike the previous two, need a credit check and may have higher interest rates. They can, however, cover the entire cost of attendance.

- Perkins Loans: These are low-interest loans offered to undergraduate and graduate students who are in desperate need of funds. They feature a set interest rate and many repayment alternatives.

- Income-Driven Repayment Plans: Income-driven repayment plans are available for federal loans, which limit your monthly loan payments to a percentage of your discretionary income. In addition, some plans provide forgiveness after a set number of years of eligible payments.

- Loan Forgiveness Programs: There are various federal loan forgiveness programs available, including Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and others. PSLF, in example, provides complete loan forgiveness after ten years of public service.

Private Loans and Risks

Banks, credit unions, and private lenders provide private loans. They can be handy when federal loans do not cover all of your needs, but they come with some risks and considerations:

- Higher Interest Rates: The interest rates on private loans are often greater than those on federal loans. Your creditworthiness will have a significant impact on the rate you are offered. To achieve better terms, you must have an excellent credit score or a co-signer with one.

- Variable Interest Rates: Many private loans have variable interest rates, which can rise over time and result in greater payments in the future. For greater predictability, federal loans often have fixed interest rates.

- Fewer Borrower Protections: Private loans do not provide the same borrower protections as federal loans. They may not, for example, offer income-driven repayment programs, loan forgiveness, or significant deferment and forbearance alternatives.

- Credit Checks: Credit checks are required by private lenders, and a bad credit history may result in denial or higher interest rates. This means that not all students will be eligible for private loans.

- Limited Repayment Flexibility: When it comes to repayment options and loan consolidation, private lenders may not provide the same level of flexibility. You could be trapped into a certain payback schedule with little options.

- Risk of Co-Signers:If a co-signer is required to acquire a private loan, they share responsibility for the loan. Any missed payments or defaults can harm their credit.

Less Forgiveness Opportunities: Loan forgiveness schemes are not often available with private loans. This means you’ll have to repay the entire loan amount plus interest, with little options for forgiveness.

The Burden of Repayment

Repaying student loans can be a difficult and unpleasant undertaking. Following graduation, many students find themselves with massive debt to repay while navigating the volatile job market. Repayment may have long-term consequences for their financial well-being and future ambitions, including as purchasing a home, establishing a family, or saving for retirement.

Why This Blog Was Created

This online resource was designed to aid students in coping with the essential issue of student debt. We understand that many students and recent graduates are unclear about how to manage their student loans, understand their options, and plan for a debt-free future. Our objective is to give students with appropriate information, resources, and solutions to assist them in managing their student debt and taking control of their financial destinies.

Bottom Line

Student debt is a major issue that millions of students and graduates throughout the world face. This website was established to serve as a beacon of hope and a great resource for anyone looking for help with their student loans. By researching loan kinds, repayment alternatives, budgeting, and debt reduction tactics, we hope to assist students in taking charge of their financial lives and reducing the burden of student debt. Our mission is to assist you in achieving financial independence and prosperity.

Aisha Turner

Aisha Turner is a well-known advocate for financial literacy and activism. She is well-known for her never-ending efforts to assist people in navigating the complicated world of student debt. Aisha, a bold black woman, has dedicated her life to raise student debt awareness. She provides excellent advice and motivates countless others to break free from its constraints.

Aisha Turner’s blog is a lifesaver! Her advice is concise, practical, and made a real difference in managing my finances.

Highly recommend!

Mia Anderson

Eastern State University

Aisha’s financial posts are pure gold. Her tips are easy to follow, and they’ve helped me make significant progress in tackling my debt. She’s a true financial guru!

James Wilson

Midtown College

Aisha Turner’s debt wisdom is fantastic. Her advice is clear, actionable, and her posts have been a source of inspiration as I work towards financial freedom. Thank you, Aisha!

Olivia Martin

Lakeside Community College

Our Best

Latest Posts

Cancel Student Debt

Blog Posts

Your Guide to Financial Freedom

Student Loan Forgiveness

Student loans have two sides to them. They give a road to further education but are too expensive. Fortunately, there is a hope.

Read More →

Student Loan Debt Repayment

Are you feeling overwhelmed by your student loan debt? You’re not alone. There are several effective student loan debt strategies.

Read More →

Burden of Student Debt

In recent years, student loan debt has arisen as a big issue. It affects the lives of young Americans as well as the entire economic.

Read More →

Biden Student Loan

The Biden administration has made significant strides in addressing the country’s increasing student loan debt crisis.

Read More →

Start your freedom

Learn more to start your financial freedom.